As the world finally turns the page to a new post-pandemic chapter, one thing really evident in the financial sector has been the increase in the customer digital experience. If a lesson was learned there, it is that the users of financial services could directly carry out transactions by themselves, provided that the institutions give them the confidence, the tools, and the necessary options to have enough digital trust.

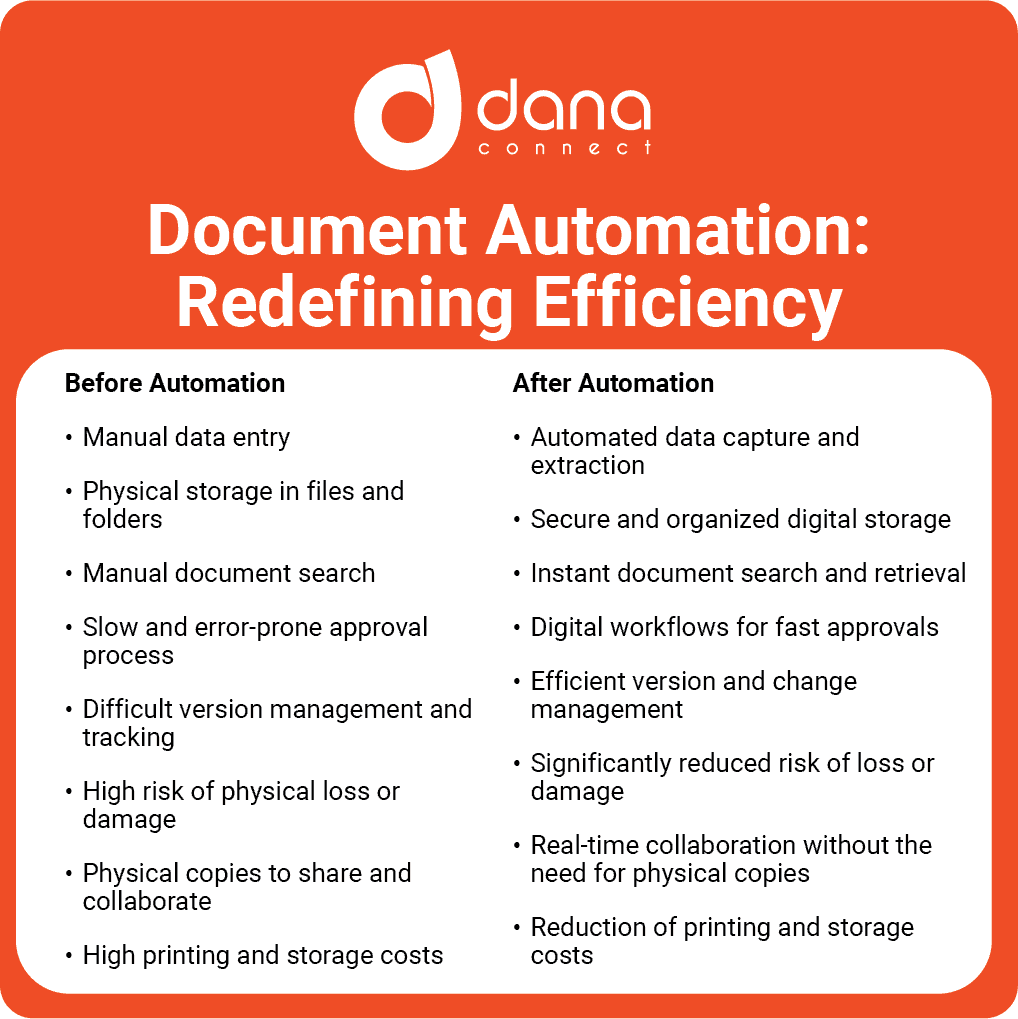

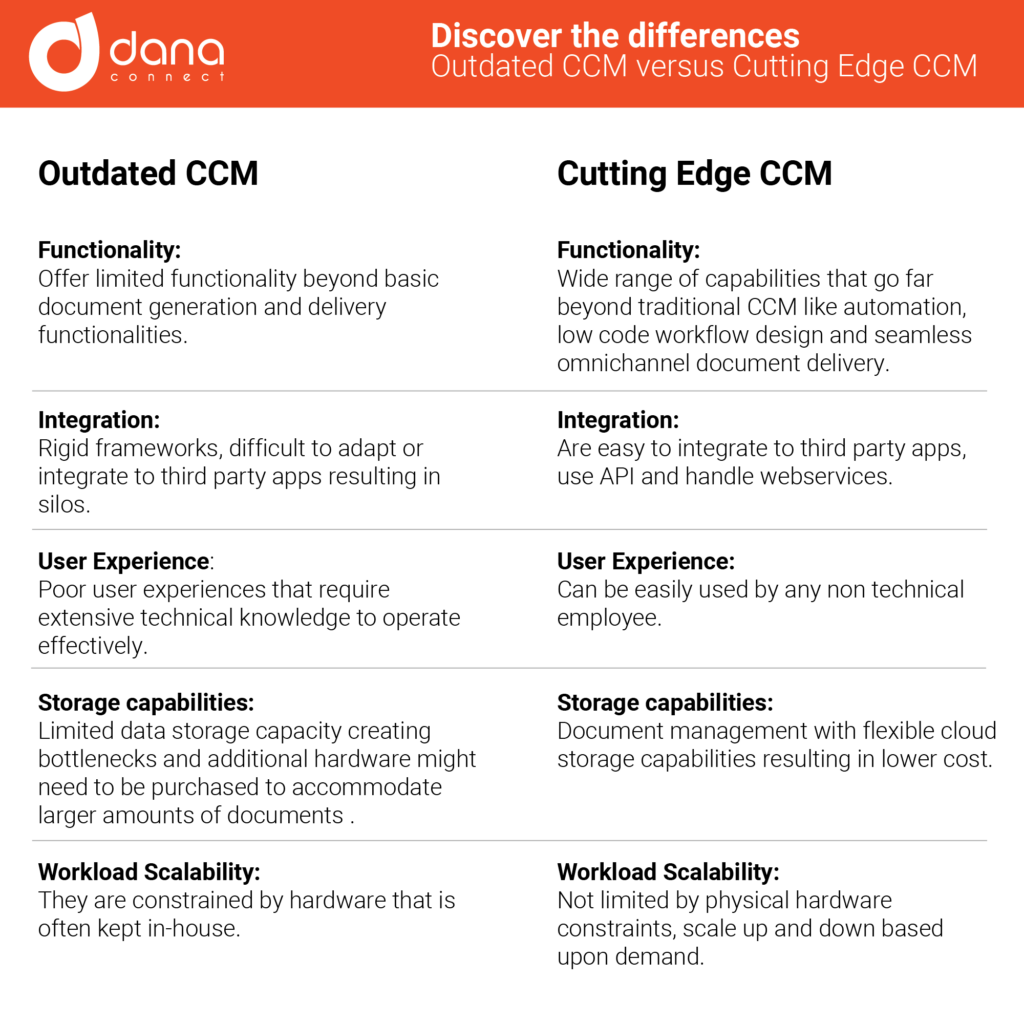

We are talking about a digital transformation that took the front stage due to a harsh global event that showed that the financial sector executes many processes that could be perfectly automated and remote by maximizing the use of technology.

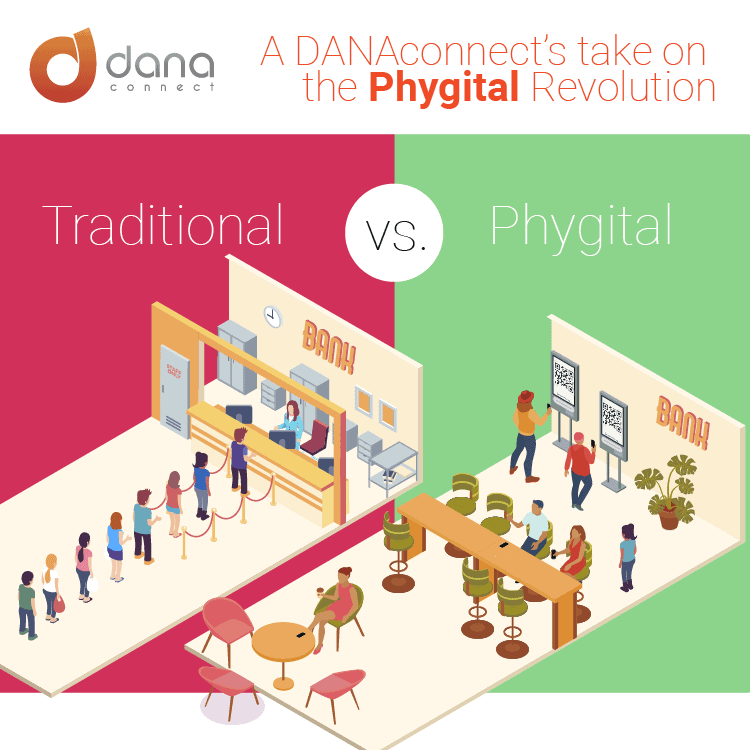

Do we have to go back to branches being crowded with customers who are going to hand in a copy of their documentation, or who are waiting in line to open or unblock an account, if they can do so digitally? Do they have to send the signed documents by post mail? The answer is evident now, but maybe it wasn’t as clear a year ago. This new reality could translate into efficiency, cost-effectiveness, and a user experience tailored to the client’s needs.

What is Digital Trust?

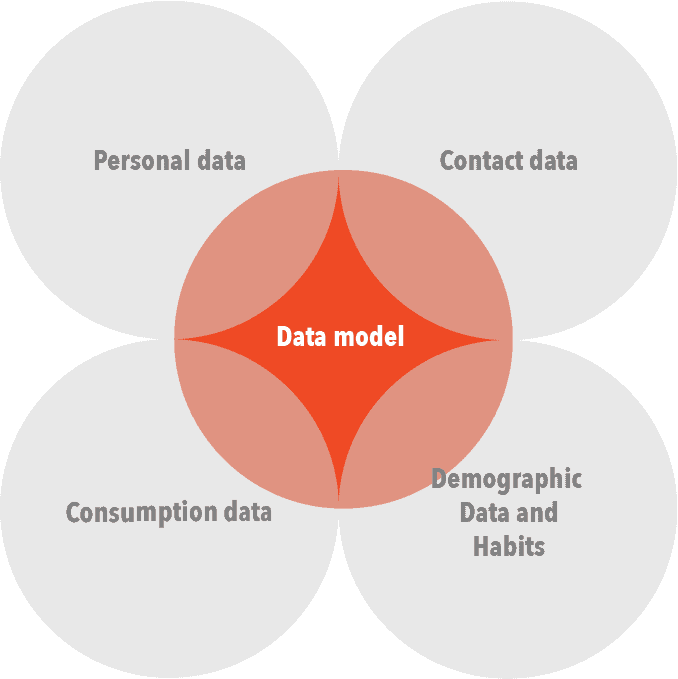

Digital Trust is the confidence that customers put in your organization to collect, store and use their data in a way that is safe and beneficial for them.

Transversality and responsiveness are the keys to digital trust

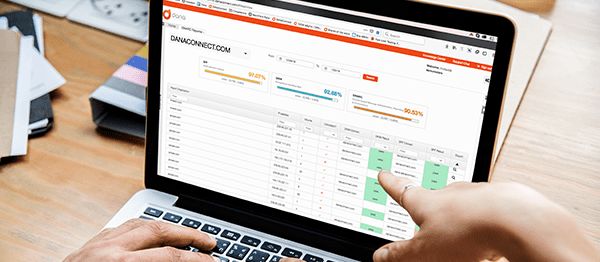

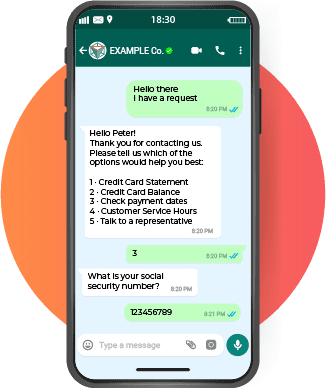

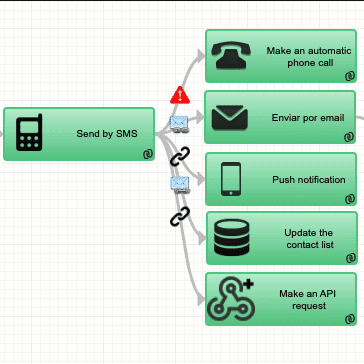

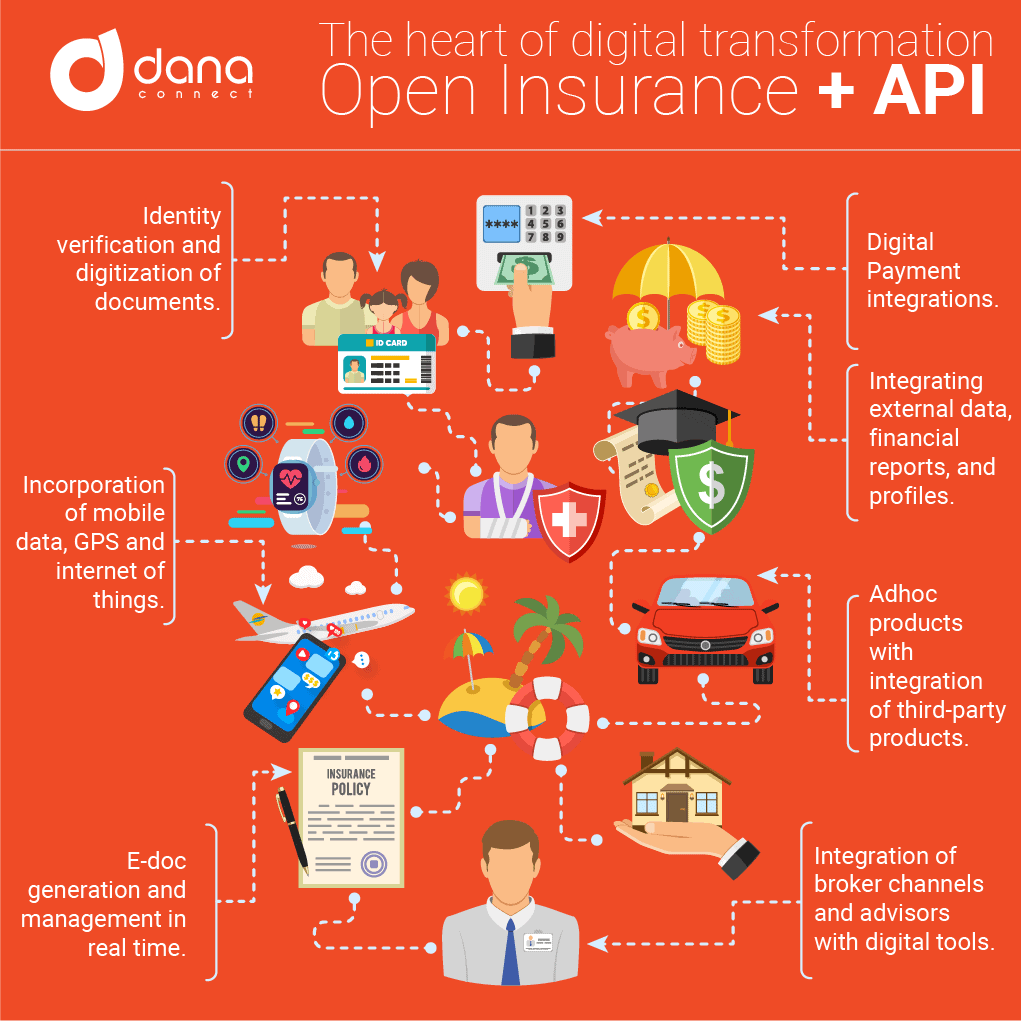

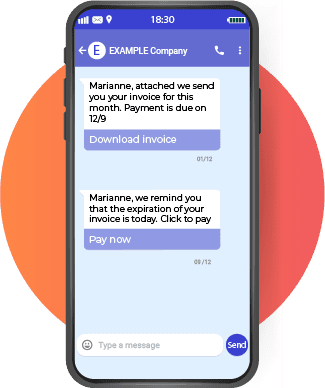

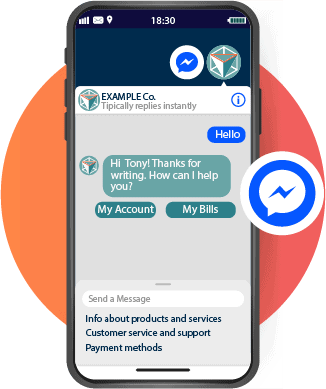

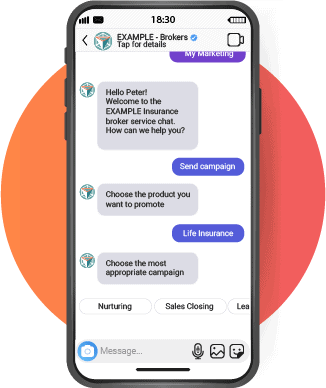

Adopting an automation platform, flexible enough to cross your organization transversally and go through departmental silos, gives financial institutions the ability to map processes between all company departments. A centralized platform makes it also possible to govern all customer communications in a unified way, store customer’s contact data, files and documents in one place, making them accessible to the entire organization.

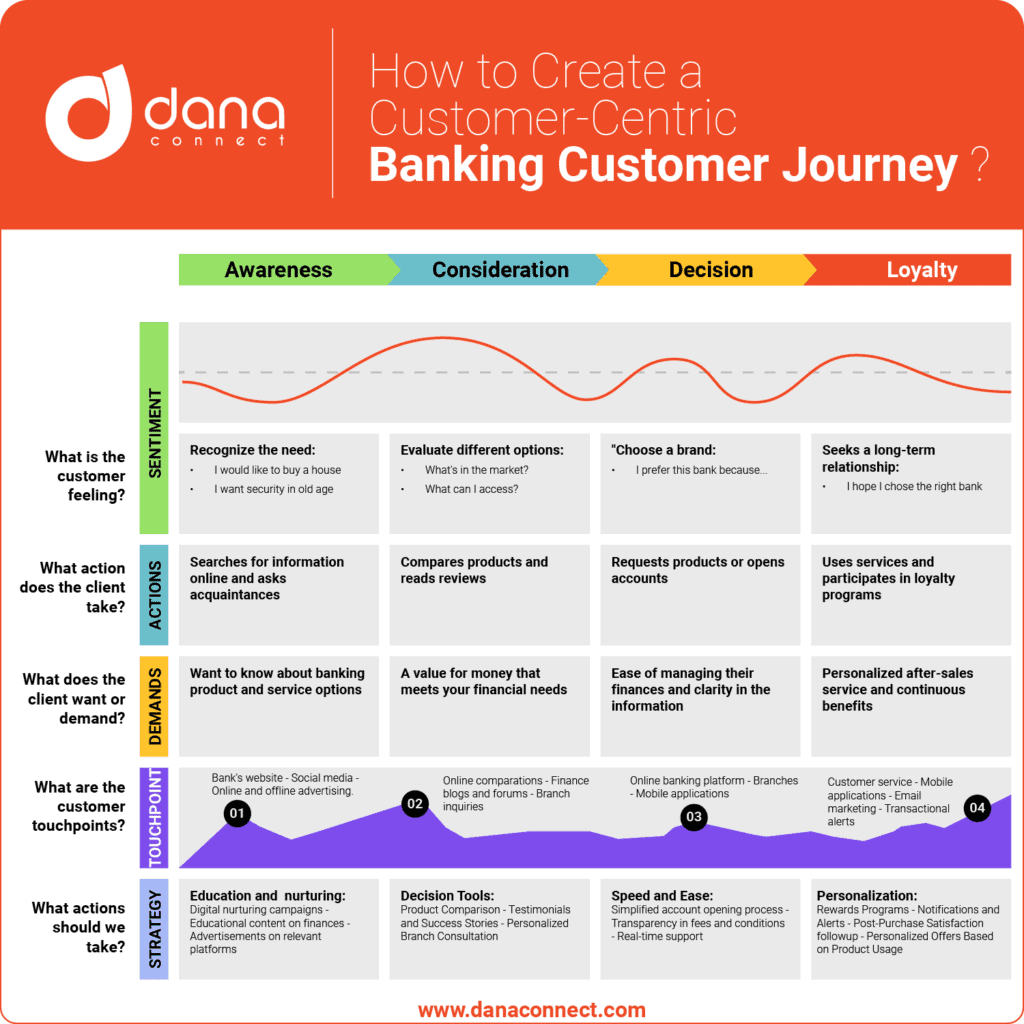

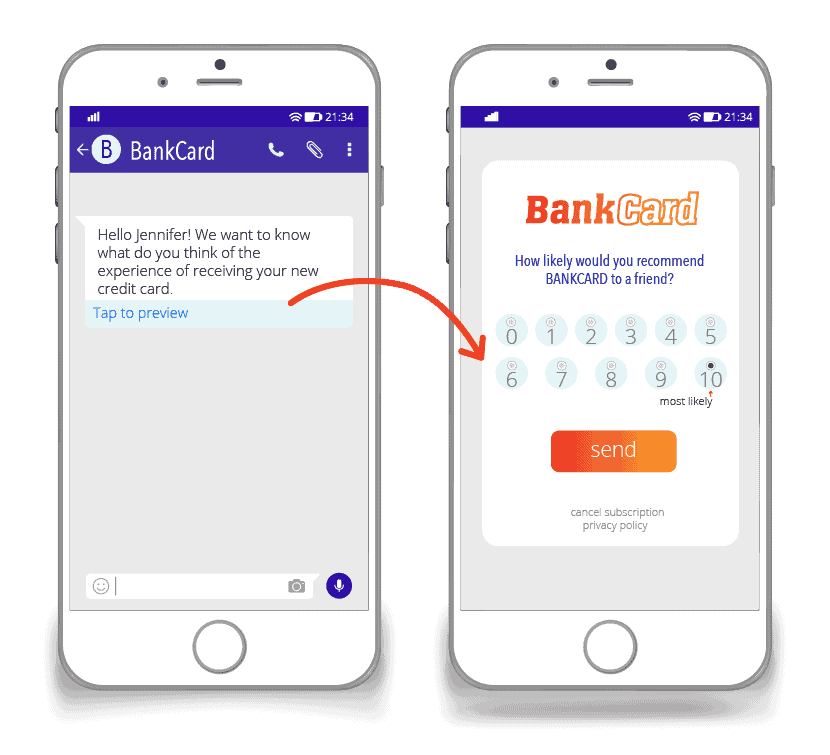

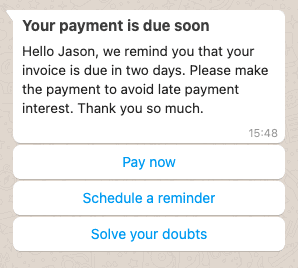

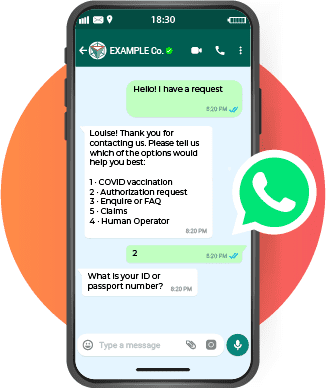

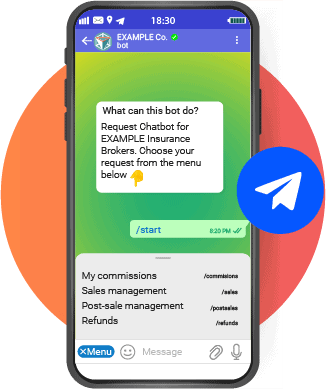

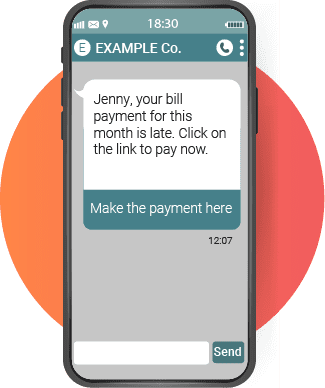

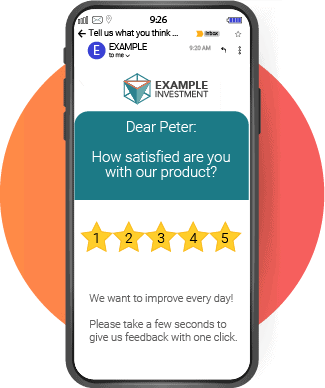

It is unifying the communications that guarantees the speed and effectiveness in all the contact points through multiple channels to improve the customer journey in the long term, before, during, and after the sale, thus involving all departments that directly contact the customer.

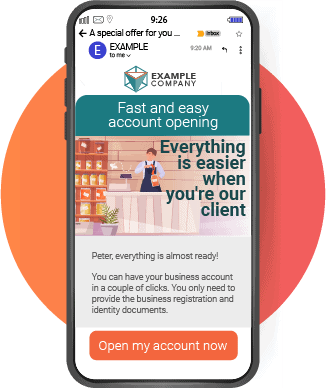

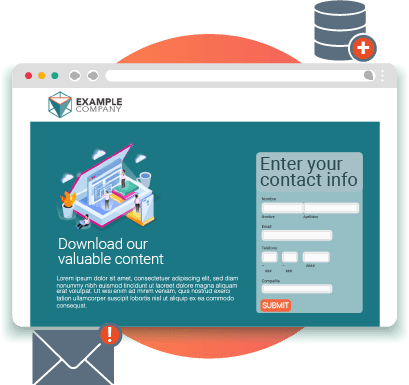

Self-service for customer account creation that translates into satisfaction

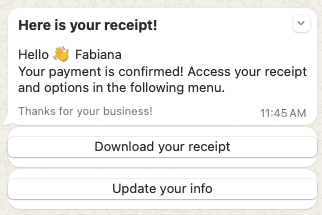

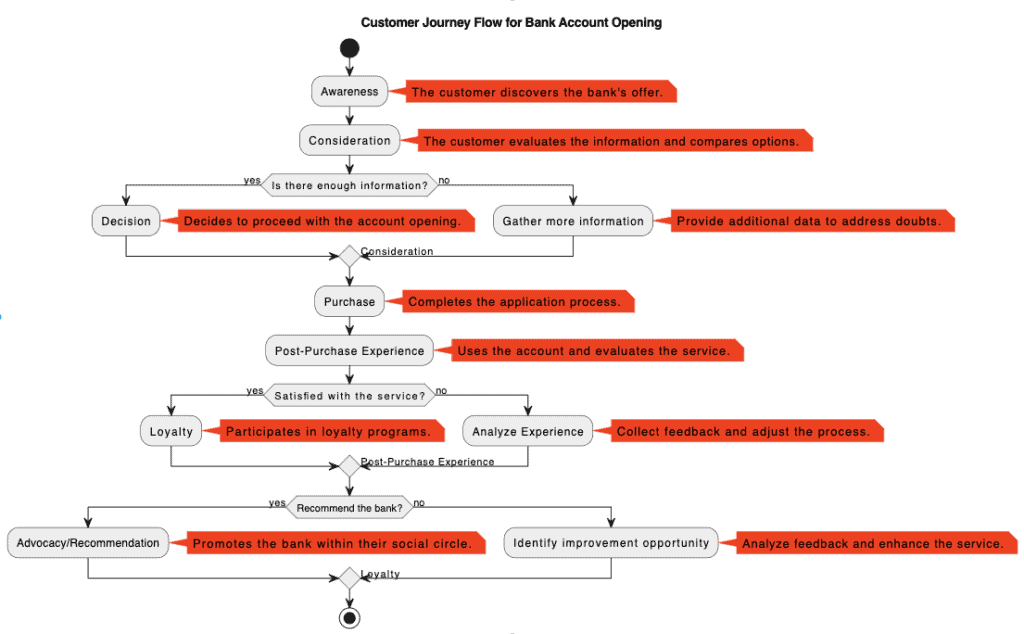

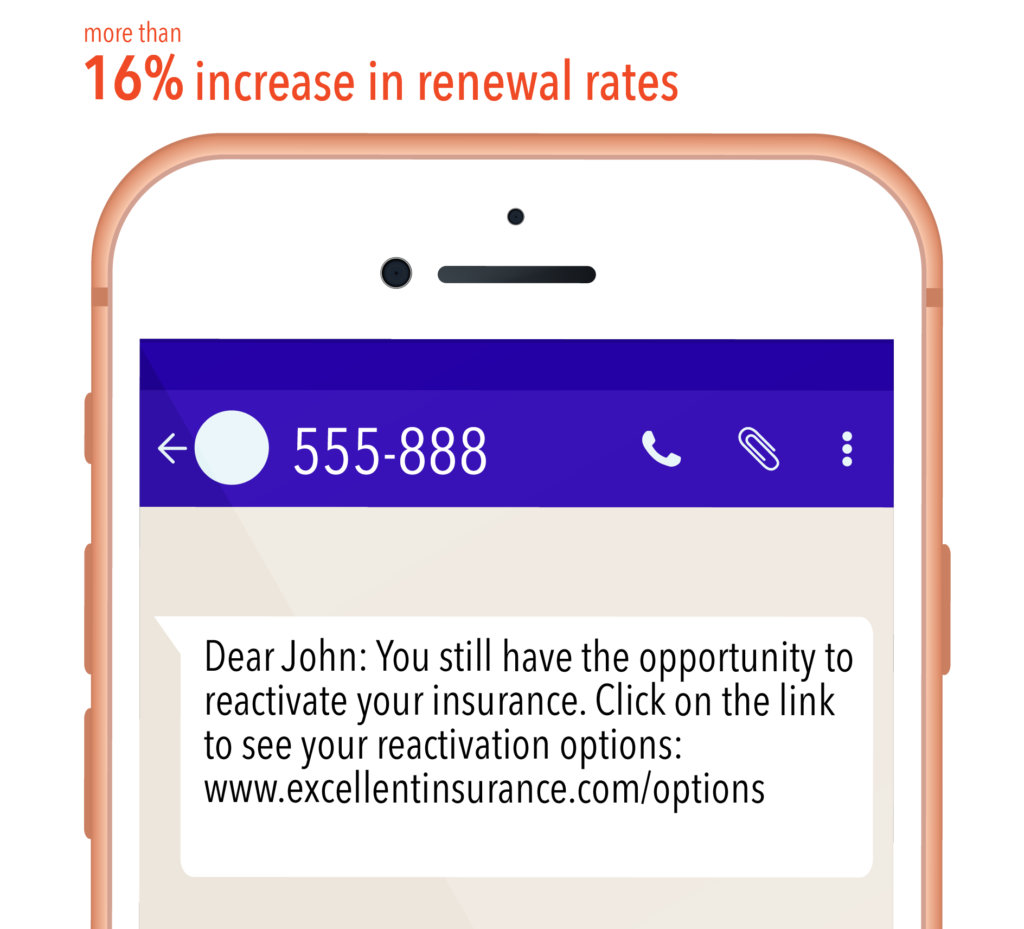

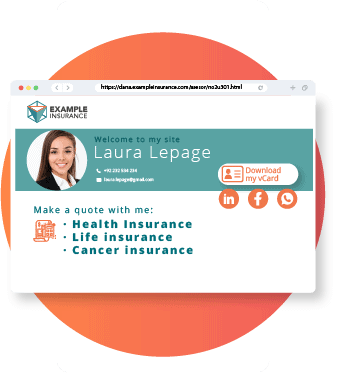

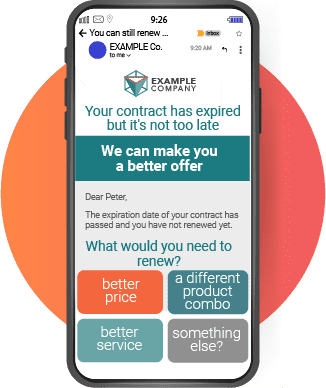

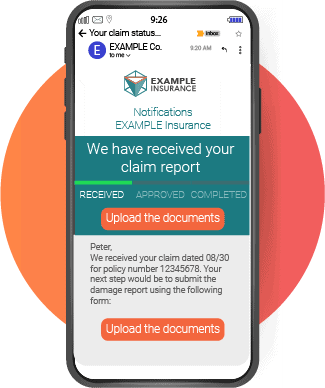

A lot of effort and money is spent in getting customers, and onboarding is their first impression, so it is fundamental to do it well. This first contact is an excellent opportunity to show that doing business with your organization is easy. Automating onboarding allows sending all the information that a customer needs after acquiring a product and the information to enable their customer’s account.

Customer dossier automations allow, among other things:

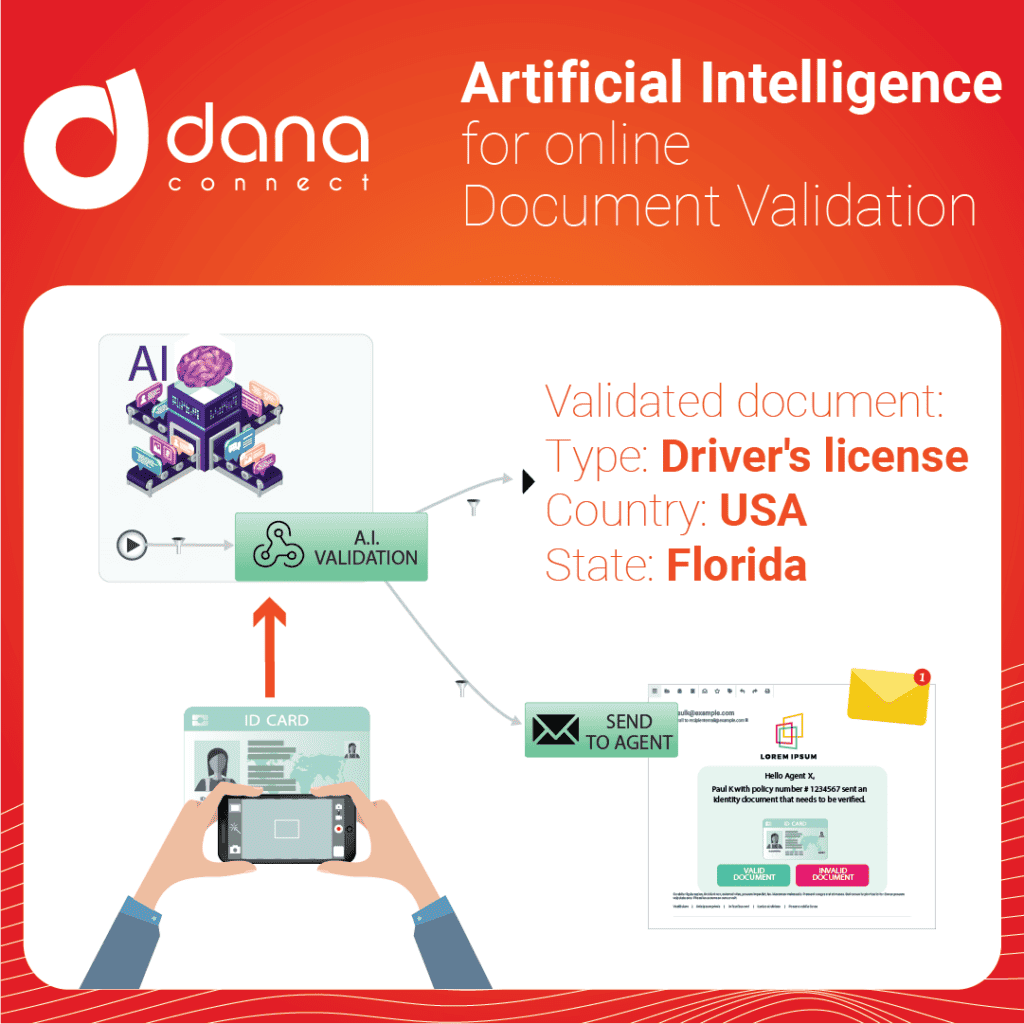

- Use customer time to input their data in a structured, digital way

- Self consignment of personal documents

- Make a way to route dossier follow ups by agents

- Follow up account activation

- Promote the first use or enablement of the account

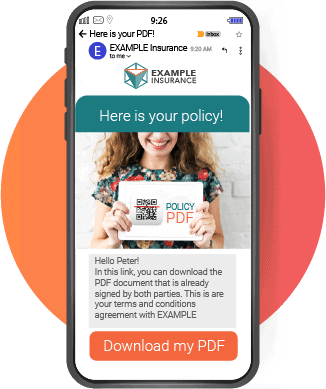

- Send documents with a digital/electronic signature, signed by both parties

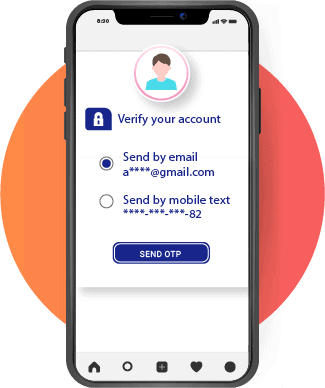

- Create one-time passwords (OTP) delivery for their first login

Automations of this kind improve the customer experience, reduce the work hours per employee and the call center volume.

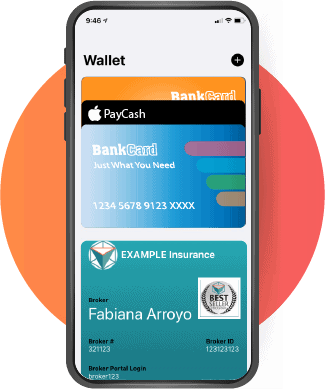

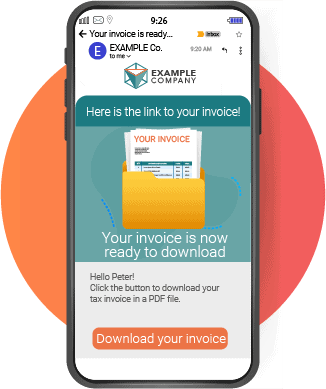

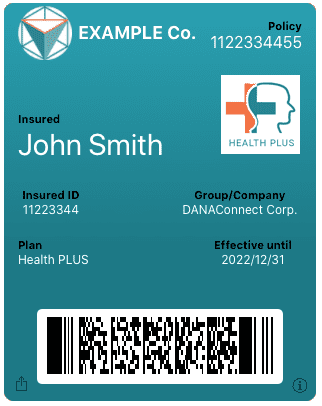

Seamless cross channel access to documents is achieved by centralizing

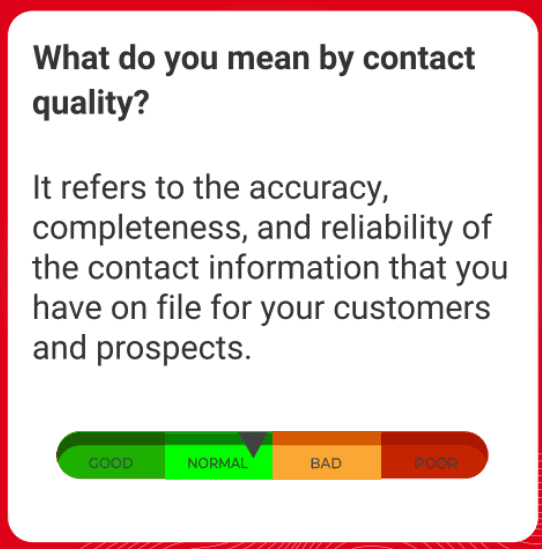

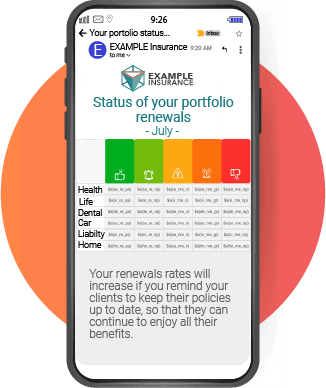

Centralizing customer data is critical to achieving a seamless and satisfying customer experience. Your customers need to be able to access their data consistently, through the channel of their choice, at the time they need it.

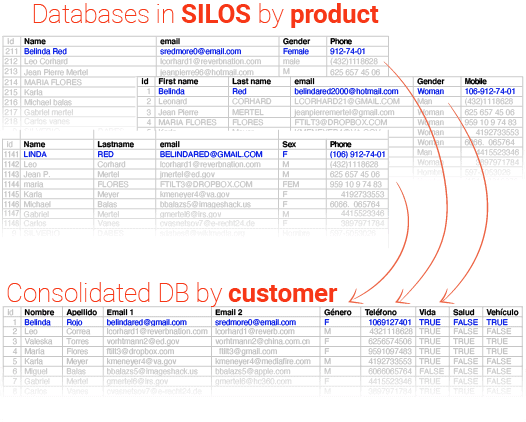

However, your different departments and different applications may not have centralized customer information. One department could have the Gmail and another the Hotmail address, or the cell phone number from 4 years ago. The same happens with the documents of the client’s dossier. These are the types of discrepancies that create disjointed and disappointing customer experiences.

The fragmentation of data is equally disappointing for your internal customers: your employees. Particularly, in those departments that want to take advantage of the information to gain competitive advantage.

WEBSITE -> More information on automated document handling and delivery

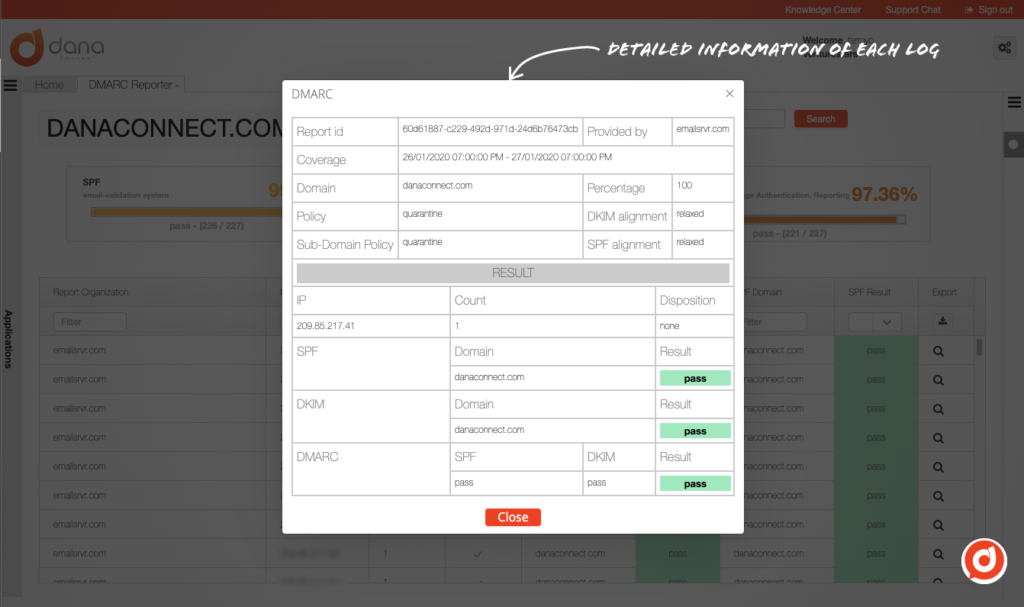

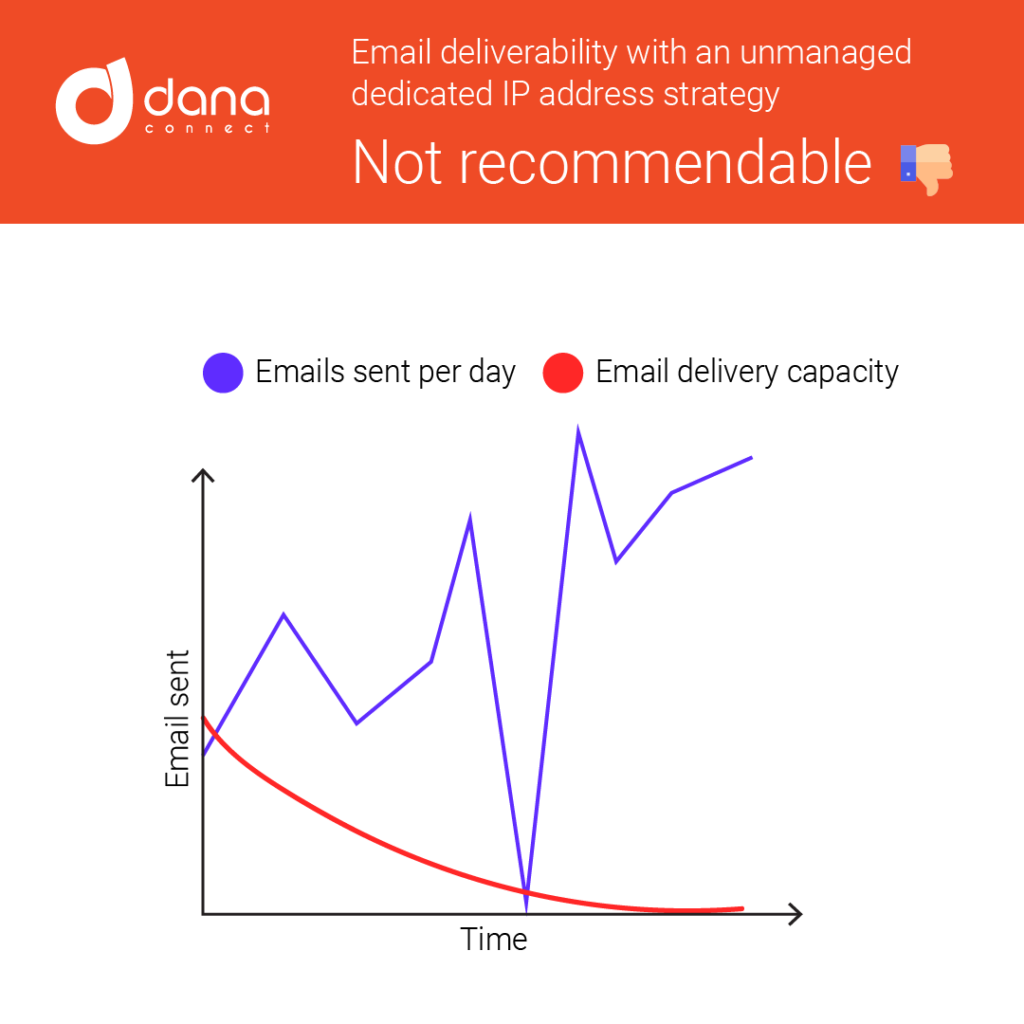

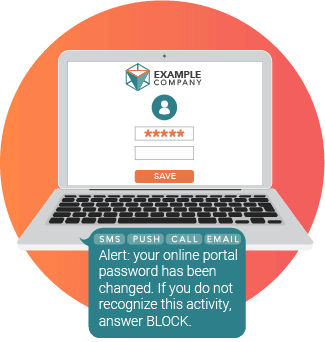

To create trust, privacy should be more than complying with regulations

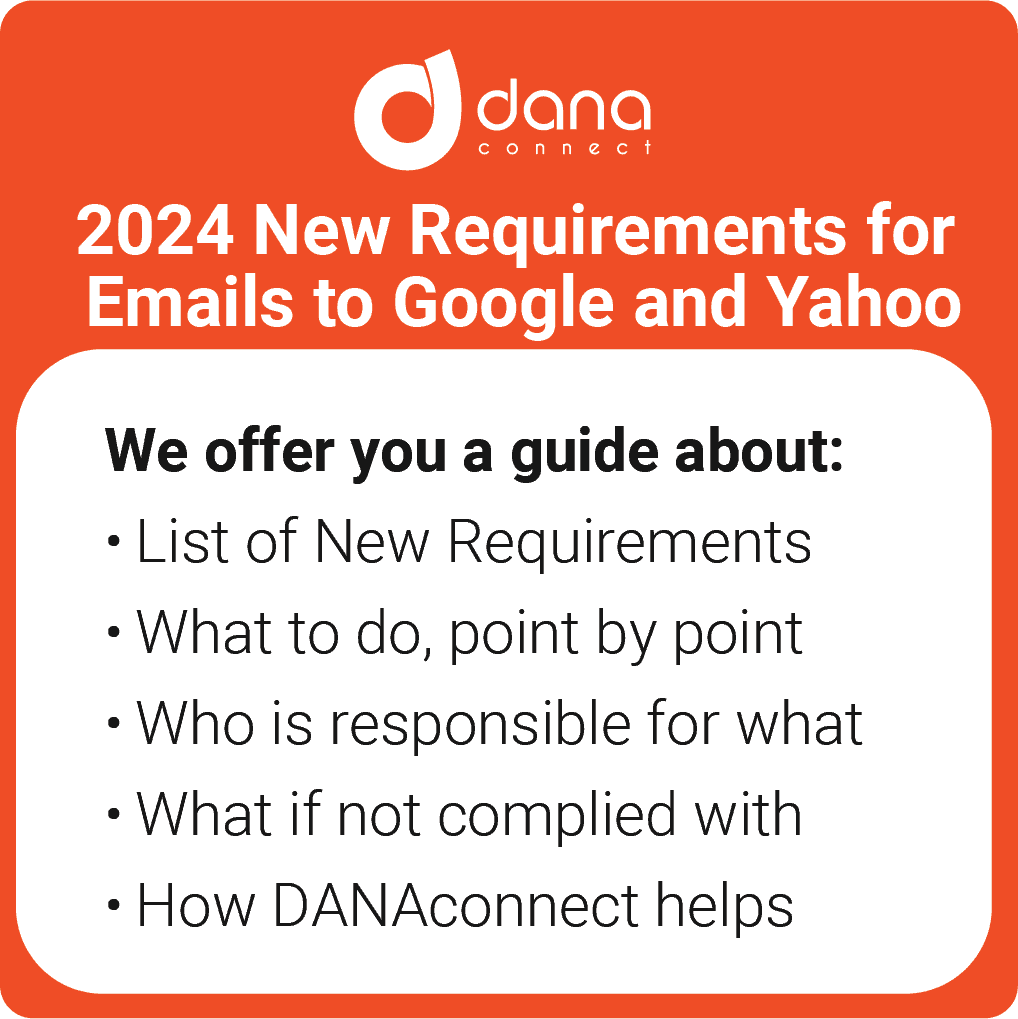

The GDPR and CCPA privacy regulations are not there just for government compliance, they are actually there to comply with your clients. These give the guidelines for companies to be good stewards of their customer data. Like loyalty, trust is something that is built with your customers over time.

Complying with regulations of this type implies having control over all the outbound communications that leave your organization.

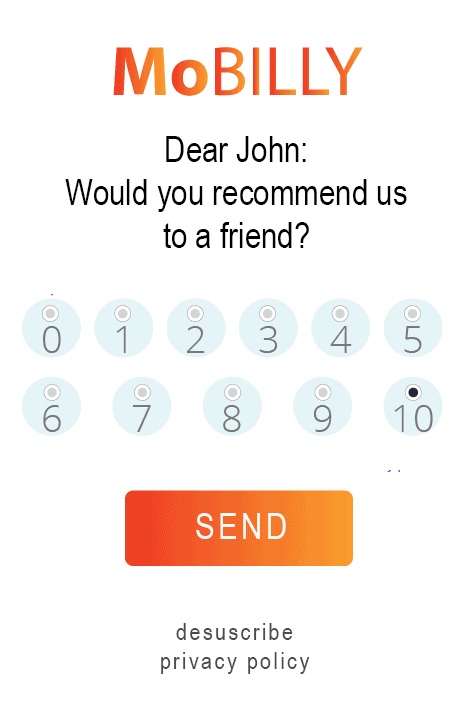

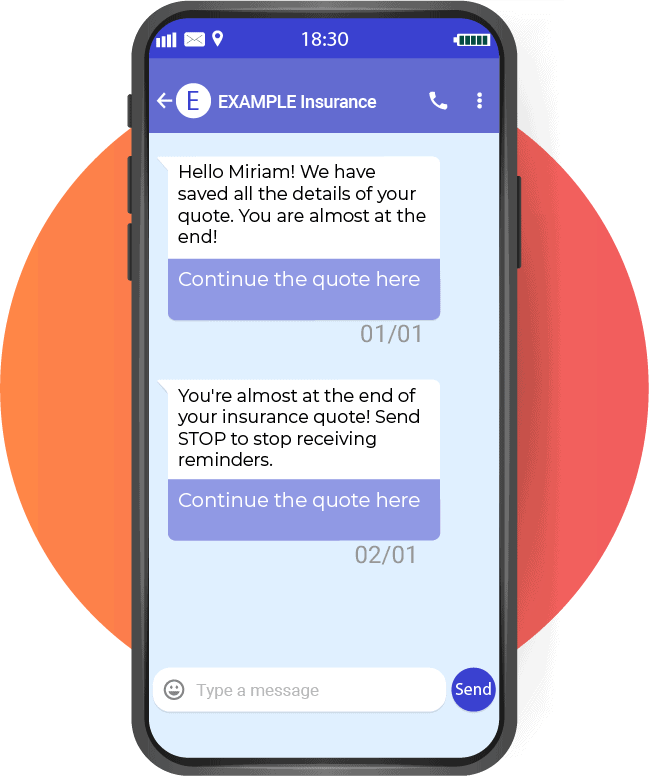

At every stage of the user’s journey, your systems must ensure that customer data is protected and secured, but it is equally important to be able to control that the client is not being bombarded with communications from all departments.

The strongest lesson has been that traditional financial institutions must deepen their strategy to improve and guarantee cross channel availability that solve simple problems, streamline processes, simplify transactions and improve customer satisfaction.