Video signature with biometric ID validation uses AI for real-time facial recognition and behavior analysis, ensuring secure transactions and access.

In this growing catalog you can find use cases with specific solutions for the needs of your industry

Dynamic Generation of PDF document with digital signature from data

Automation to generate a digital service contract, based on a template, which inserts a digitally signed certificate in the issued document.

Recovery of Lost Customers Automation

Sequence of messages sent to the customer once they unsubscribe, aimed at understanding why the customer opted out, fine-tuning their profile, and offering optimized personalized options.

Cloud SMTP with reports

Interface that allows applications to connect using SMTP to send in bulk highly traceable emails.

Electronic Invoice with Automated Collections Follow up

Automation that sends a collection sequence starting with the electronic invoice and track the payment with reminders.

Telegram Chatbot for Sales Force Requests

Pre-structured automated responses to handle internal customer service requests made by the salesforce.

Lead Capture Landing Page

Prospect data capture web form integrated into a landing web page that automatically sends an email or SMS after the prospect’s contact information is captured.

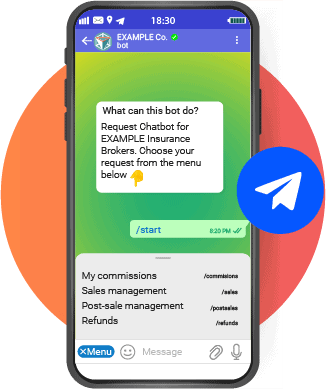

Telegram Chatbot for Broker Requests

Pre-structured automated responses to handle internal customer service requests made by insurance agents and intermediaries.

Telegram Chatbot for Customer Service

Customer service solution that automates responses to messages and document self-services integrating chatbot technology through Telegram.

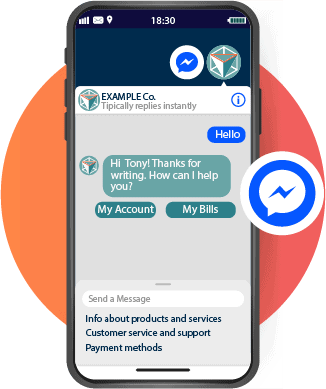

Facebook Messenger Chatbot for Customer Service

Customer service solution for banks that allows direct communication with customers, automating responses to messages and integrating chatbot technology through WhatsApp application.

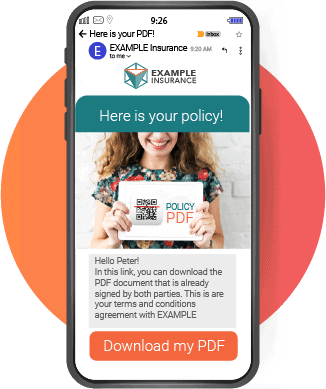

Digital Policy Document Generation

Creates the document dynamically with the customer’s data and adds a digitally signed certificate before sending it to the new client.

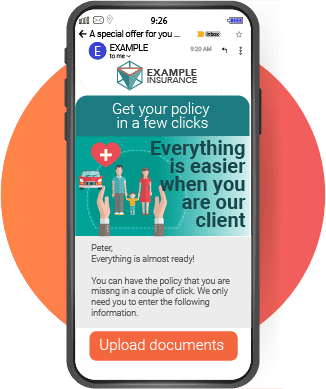

Insurance Cross Selling with Underwriting Automation

Automates the Insurance Cross Selling, promoting, underwriting, and e-closing new policies to a segment of your current portfolio.

Self-managed Customer Dossier Creation

Allows clients to self-manage their files, ensuring that all the documents needed to open the files are present and sends the necessary reminders.

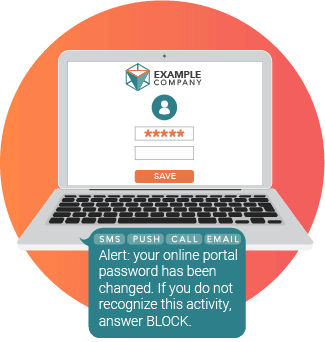

Customer Profile Change Alert

Notifies the client in real time when their contact information or passwords are changed and gives a tool to confirm it.

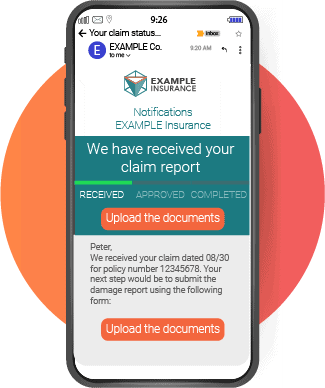

Automated Insurance Claim Follow up

Message sequence which keeps the insured informed of the progress of their claim as it progresses.

Digitally Issued Service Contract

Automation to generate a digital service contract, based on a template, which inserts a digitally signed certificate in the issued document.

SMS Gateway

Allows to send text messages to mobile terminals around the world without having to deal with expensive infrastructure or connections from multiple operators.

Annual NPS Measurement – Net Promoter Score

Gauges customer loyalty by sending a survey to customers asking the single question to respond with a click

Customer Satisfaction Survey After a Claim – Claim CSAT

Automatically sends a survey after a claim process that allows the customer to submit their feedback with a single click.

New Customer Effort Survey – Onboarding CES

Automation that asks customers how easy was the onboarding process using the Customer Effort Score methodology and trigger a followup according the response.

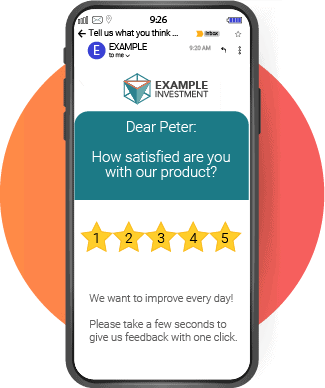

Customer satisfaction by product – CSAT Product

Automatically sends a message by email or text message to respond with a single click the customer satisfaction by product.

Checklist for digital customer onboarding

The checklist for client digital onboarding is an automation that gives the tools to the customer for completing tasks and uploading personal docs.

Customer contact data update automation

Customer contact data update automation provides alternative channels to collect contact information if message delivery fails.

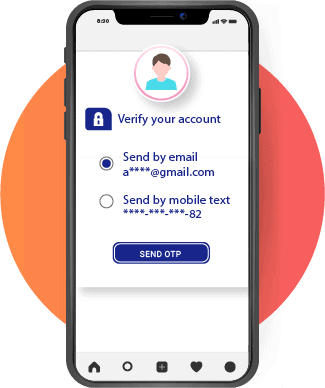

Cross Channel One Time Password OTP

Automated solution that allows users to log in to a session or transaction through the verification of code sent through a different different.

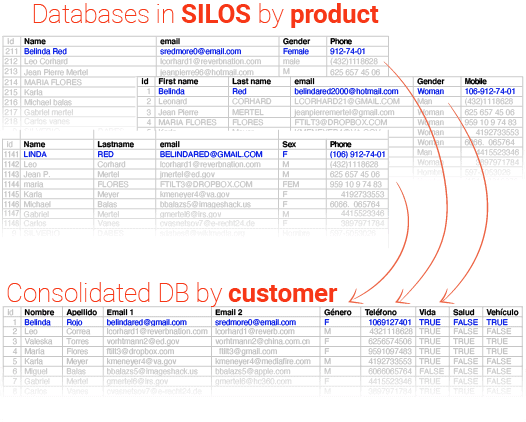

Customer centric data model for Insurance

Customer centric data model provides the basis for storing data to track the evolution of customers and improve customer experience in insurance.

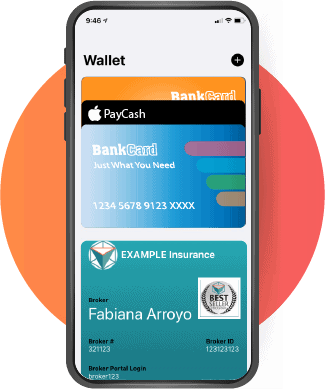

eWallet Insurance Broker Card

Used with the mobile e-wallet applications so that brokers and promoters can view the complete and up to date information of their client portfolio

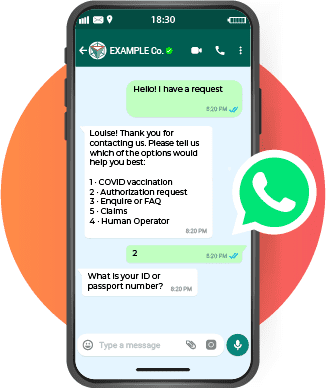

WhatsApp Business Chatbot for Insurance

WhatsApp Business Chatbot for Insurance is a customer service solution that automates responses, guarantees speed and efficiency at low cost

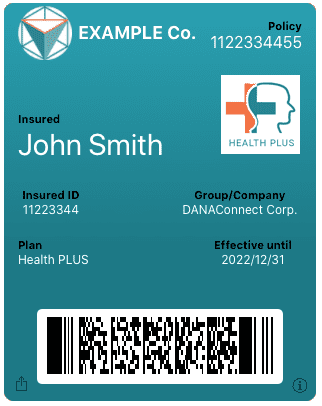

Digital Insurance card eWallet

Digital insurance card to distribute to your customers by email or SMS channels with always up to date information of services and resources