The financial sector faces increasing challenges related to security and efficiency. Digital fraud, such as identity theft and unauthorized access, causes millions in losses annually and threatens user trust. At the same time, customer onboarding processes tend to be cumbersome and lengthy, leading to frustration and abandonment.

In this context, biometric validation emerges as a technological solution capable of transforming these dynamics. Based on unique individual characteristics, such as fingerprints or facial recognition, biometrics enable identity authentication in a more secure, agile, and reliable way. This article explores how biometrics are helping financial institutions solve critical problems, optimizing both security and customer experience.

Why Are Fraud and Slow Onboarding Critical Problems?

The Impact of Identity Theft and Unauthorized Access

Identity theft is one of the greatest threats to the financial sector. It involves the use of stolen personal data to access accounts, conduct unauthorized transactions, or open fraudulent credit lines. This type of fraud causes significant financial losses for institutions and is a major inconvenience for affected customers.

Furthermore, traditional authentication methods, such as passwords, PINs, or security questions, are insufficient. These systems are vulnerable to data theft and do not guarantee that the account holder is the one accessing the system. In an environment where cyberattacks are becoming increasingly sophisticated, it is critical to implement technologies that ensure authentication based on the user’s real identity.

Slow Onboarding: An Obstacle to Customer Acquisition

The process of onboarding new customers remains a challenge for many institutions. It often includes multiple steps, such as document collection, manual validations, and additional checks to comply with regulations like KYC (Know Your Customer) and AML (Anti-Money Laundering). These processes present several issues:

- Operational Delays: Manual steps and reliance on fragmented systems slow down the time needed to complete onboarding.

- High Abandonment Rates: Customers seek fast, frictionless experiences. Studies show that lengthy processes can cause up to 40% of users to abandon registration.

- High Costs: Manual operations and document reviews require significant human resources, driving up costs.

In a competitive environment, these problems not only affect operational efficiency but also the ability of financial institutions to attract and retain customers.

How Does Biometric Validation Solve These Problems?

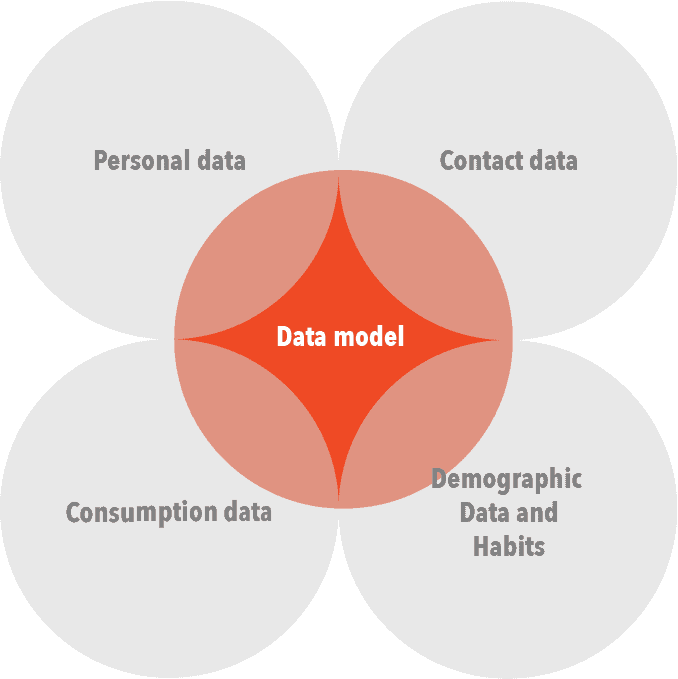

Biometric validation is a technology based on the physical and unique characteristics of each individual, such as facial recognition, fingerprints, or voice detection. Its integration into financial processes effectively addresses issues of identity theft, unauthorized access, and slow onboarding. Below, we break down how these solutions can make a difference:

Preventing Identity Theft and Unauthorized Access

- Authentication Based on Real Identity:

- Unlike passwords or security questions, which can be stolen or guessed, biometrics authenticate a person’s identity using unique and hard-to-replicate attributes.

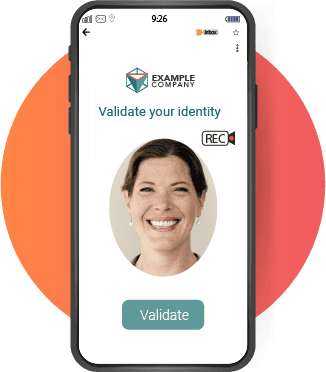

- Example: A facial recognition system can compare the customer’s real-time image with previously registered biometric data, ensuring they are the same person.

- Liveness Detection:

- This technique ensures that the person attempting to access is physically present and not a simulation using photos, videos, or masks.

- Particularly useful in high-risk transactions, such as large transfers or changes to sensitive information.

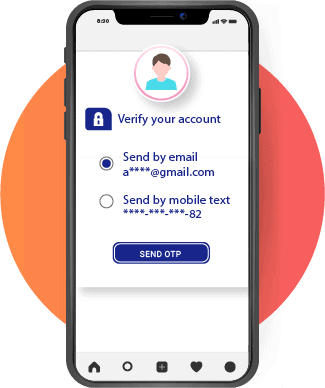

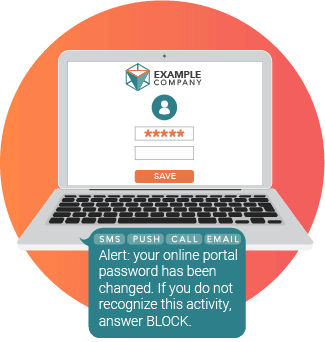

- Multifactor Biometric Authentication:

The combination of biometrics with additional factors, such as one-time passwords (OTP), adds an extra layer of security, making unauthorized access attempts even harder.

Streamlining Onboarding and Enhancing Customer Experience

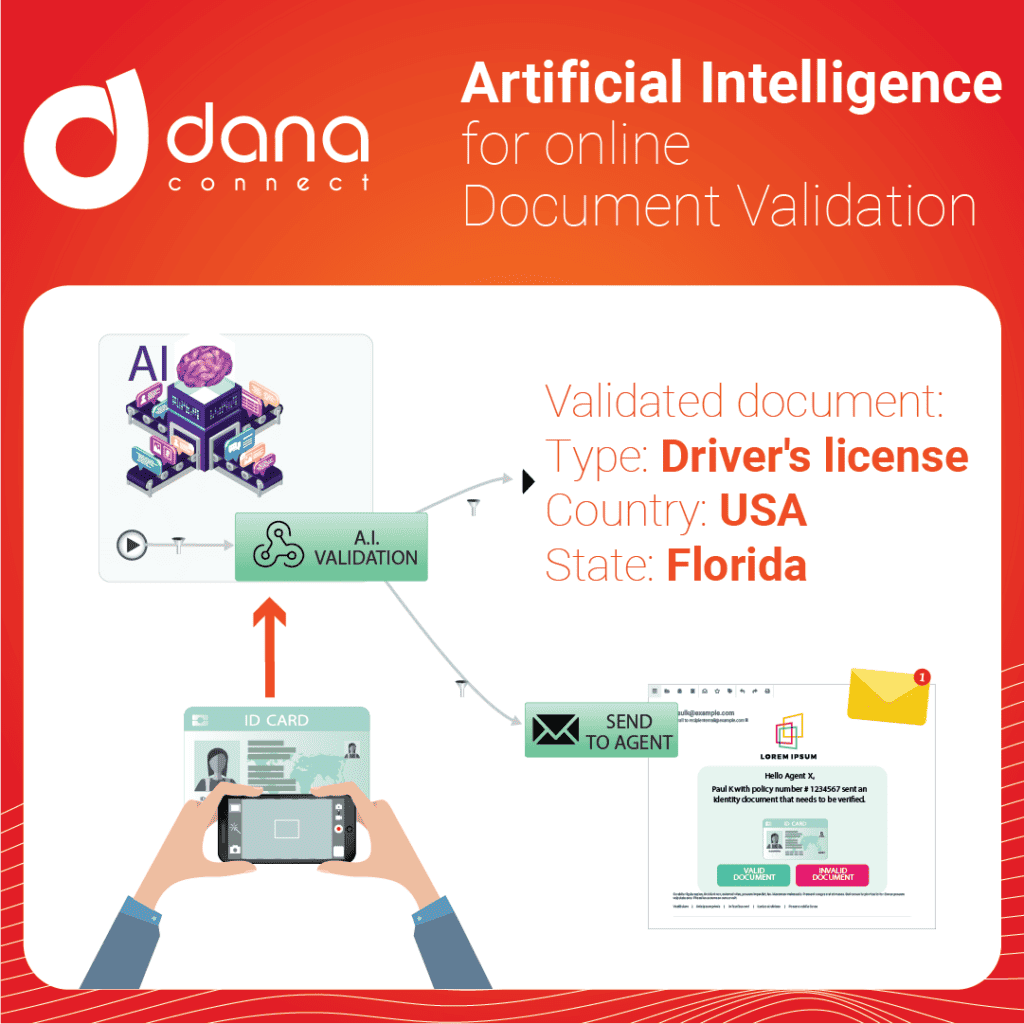

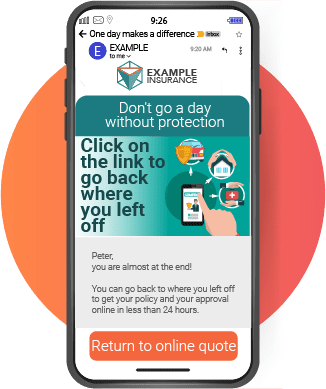

- Automating Identity Validation:

- Biometric solutions can validate new customer identities in seconds, eliminating the need for manual checks.

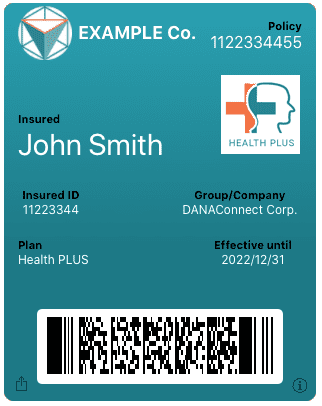

- Example: During the account opening process, the customer simply uploads a photo of their official ID and performs a live facial scan. Automatic comparison confirms their identity, avoiding delays.

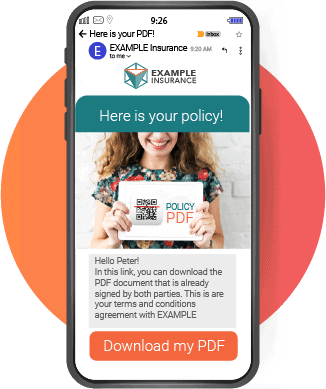

- Digital Signatures with Biometric Video:

- This method allows customers to sign legally binding documents remotely using their face as validation. Not only does it eliminate the need for travel, but it also increases confidence in the authenticity of signed documents.

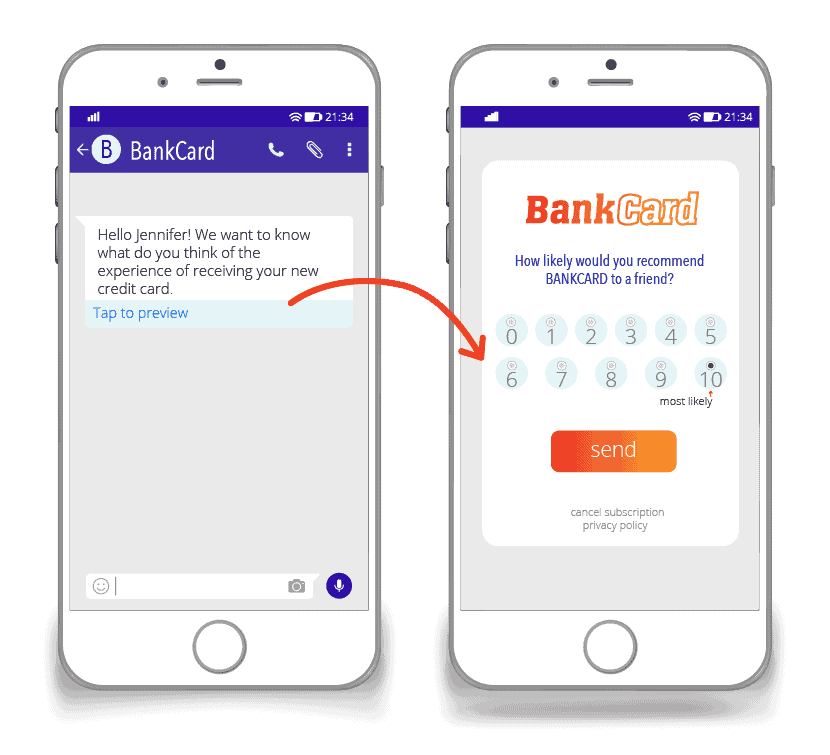

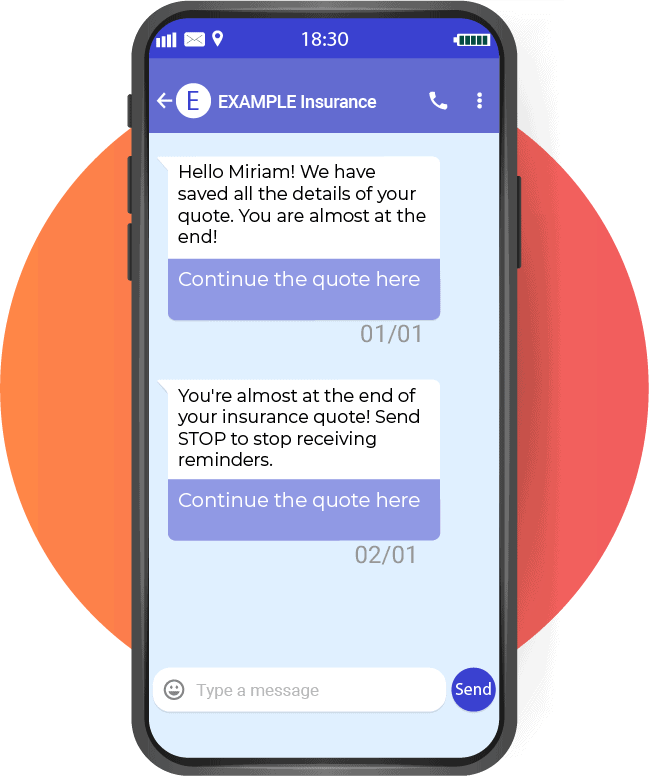

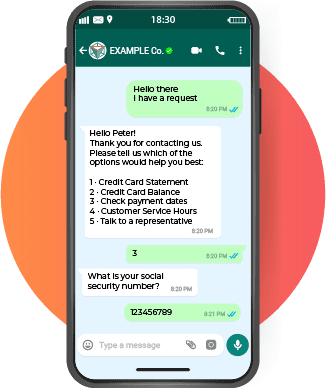

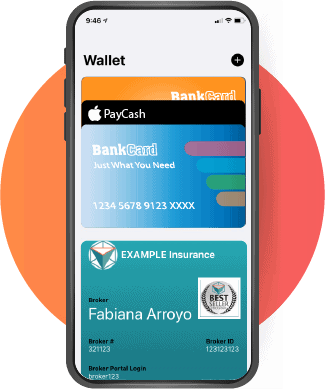

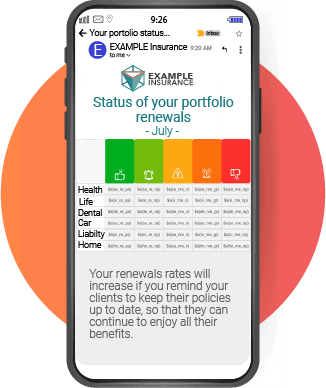

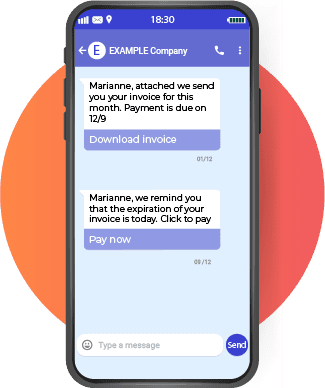

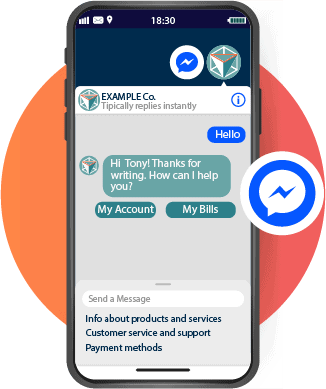

- Omnichannel Integration:

- Through APIs, financial institutions can integrate biometrics across various channels, such as mobile apps, websites, or even messaging platforms like WhatsApp. This ensures a smooth and consistent user experience, regardless of the point of contact.

Practical Example: Using Biometrics in Digital Bank Account Opening

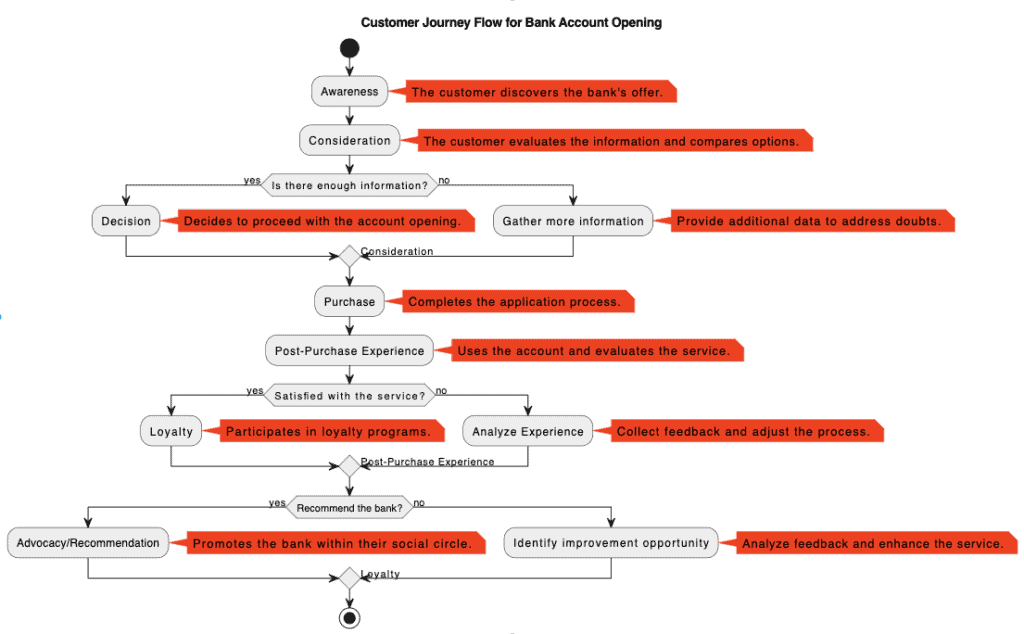

Imagine a customer wants to open a digital bank account without visiting a physical branch. Through biometric validation, the process becomes fast, secure, and completely online.

Step-by-Step Process:

- Process Initiation:

- The customer accesses the bank’s mobile app or website and selects the “Open an Account” option.

- They are prompted to enter basic information and upload an image of their ID (e.g., ID card or passport).

- Identity Validation:

- The biometric system analyzes the document, verifying its authenticity and automatically extracting relevant data.

- The customer is then asked to activate their mobile device’s camera for real-time verification. During this step, the system uses advanced “liveness detection” technology, employing variations in lighting and projected colors on the user’s face to capture how light interacts with the skin. This confirms the person is physically present and not a pre-recorded image or video.

- Authorization and Digital Signature:

- Once the customer’s identity is confirmed, the bank automatically generates the required contracts.

- The customer can review the documents and complete them using a digital signature linked to their biometric identity, directly from the app.

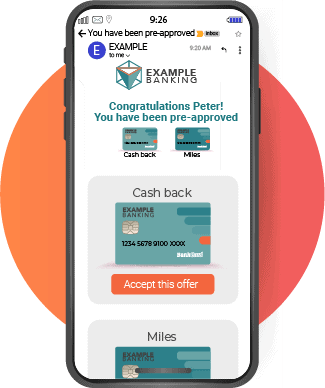

- Confirmation and Activation:

- The system validates all information and sends a notification to the customer confirming their account is active.

- In less than 10 minutes, the customer has access to their new account, ready to use.

Results:

Thanks to biometrics, the customer completed the entire process from the comfort of their home, without sending physical documents or visiting a branch. The bank ensured the procedure’s security, reduced risks, minimized operational times, and optimized resources.

Practical Example: Using Biometrics for Pensioner Proof of Life

A pensioner needs to complete their annual proof of life to continue receiving benefits. Instead of physically visiting a bank or government branch, they can complete the process from their home using their mobile phone.

Step-by-Step Process:

- Notification Reception:

- The pensioner receives a message on their mobile device (via SMS, email, or app notification) indicating they need to complete their proof of life.

- This message includes a secure link directing them to the biometric validation system.

- Identity Validation and Proof of Life:

- The system performs “liveness detection” using advanced technology that projects variations in light and colors onto the user’s face. This captures how light interacts with facial features, ensuring the person is physically present and ruling out fraud attempts with pre-recorded images or videos.

- Immediate Confirmation:

- The system compares the identity document data in the customer dossier with the biometric traits captured in the video. Once validated, the institution automatically receives confirmation of the proof of life.

- The pensioner receives a success notification without needing to take additional steps.

Results:

In less than five minutes, the pensioner has completed their proof of life from home, eliminating the need to travel or send physical documents. The financial institution updates its records automatically, ensuring pension payments continue without interruption.

Challenges in Implementing Biometrics and How to Overcome Them

Although biometrics offer innovative solutions to prevent fraud and optimize onboarding processes, their implementation is not without challenges. Understanding these hurdles and preparing strategies to address them is key to successful integration in financial institutions.

1. Protecting Personal Data

One of the biggest challenges associated with biometrics is ensuring the security and privacy of sensitive data. Biometric traits are unique and irreplaceable; if compromised, the consequences can be severe.

How to Overcome It:

- Regulatory Compliance: Adopt international standards like GDPR (General Data Protection Regulation) and CCPA (California Consumer Privacy Act) to protect customer privacy.

- Advanced Encryption: Store and transmit biometric data using robust encryption systems that minimize the risk of unauthorized access.

- Minimal Storage Policies: Collect and store only the data strictly necessary, deleting any redundant information once its purpose is fulfilled.

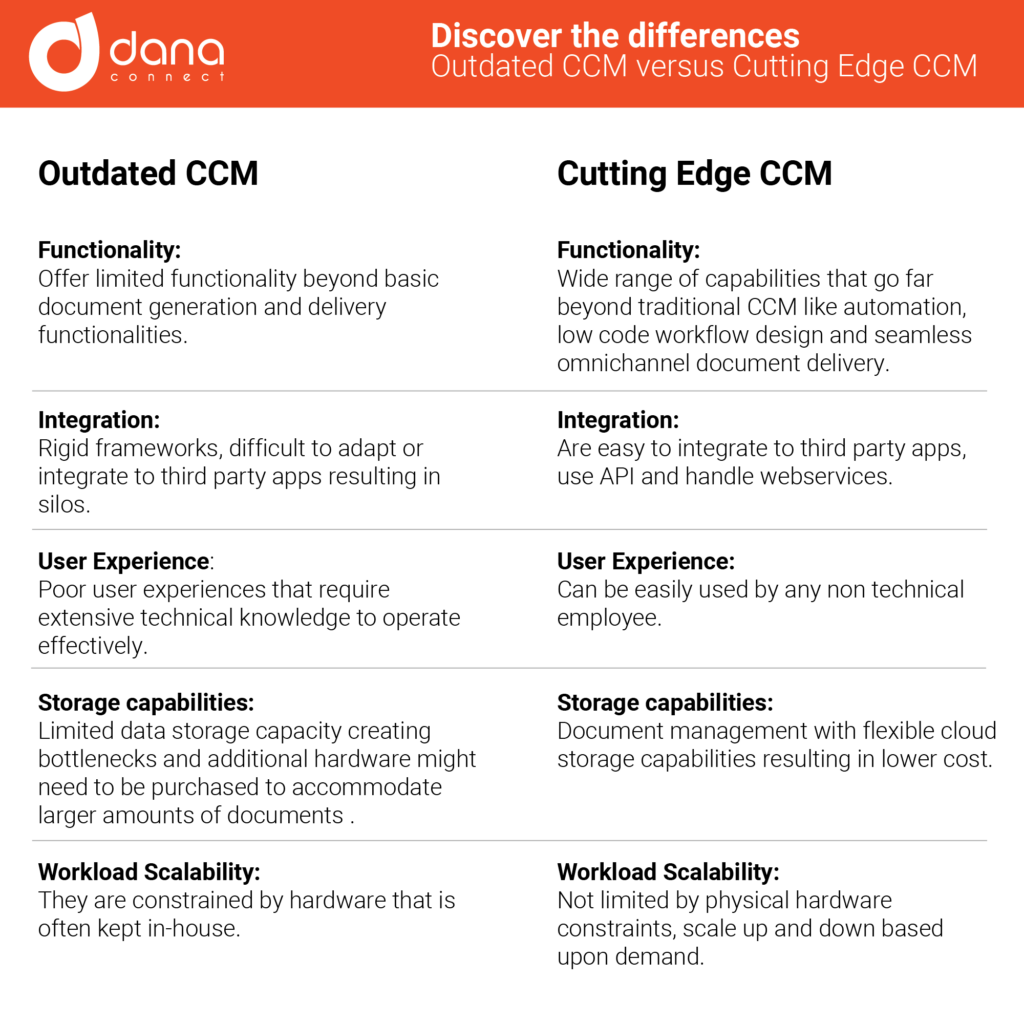

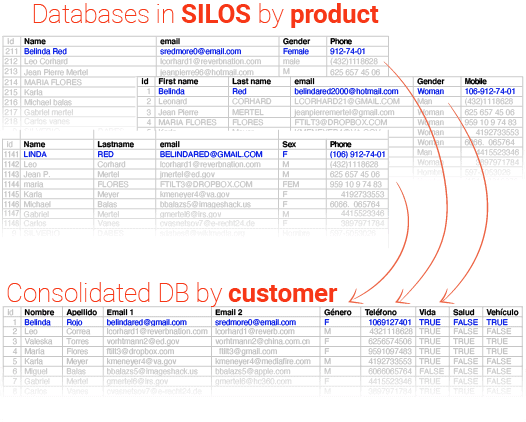

2. Technological Integration

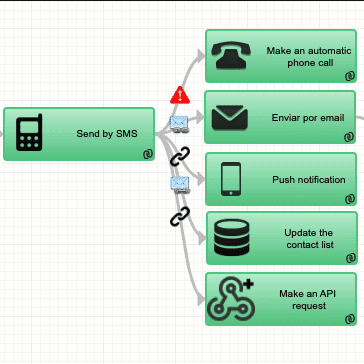

Implementing biometric solutions requires integrating advanced technologies with existing systems, such as databases, CRM platforms, or risk management tools. Lack of compatibility can create operational issues.

How to Overcome It:

- Use Well-Documented APIs: Integrate biometric platforms that offer easy-to-implement APIs compatible with multiple existing systems.

- Pilot Tests: Conduct controlled trials before full implementation to identify and resolve compatibility issues in advance.

- Partner with Experts: Collaborate with biometric solution providers who offer technical support and guidance throughout the process.

3. User Acceptance

Some customers may be hesitant to use biometric technology due to privacy concerns or a lack of understanding about its benefits.

How to Overcome It:

- Clear Communication: Explain how biometric data will be used, emphasizing the security measures in place.

- User Education: Launch informational campaigns highlighting the benefits of biometrics, such as speed, security, and convenience.

- Alternative Options: Offer additional validation methods for customers who prefer not to use biometrics, without compromising the user experience.

4. Initial Costs

Adopting biometrics may involve significant initial investments in technology, infrastructure, and training, which could deter some organizations.

How to Overcome It:

- Biometric SaaS: Opt for cloud-based biometric solutions with monthly or per-transaction costs, eliminating the need for expensive local infrastructure or large upfront investments.

5. Maintaining Accuracy Under Challenging Conditions

Biometrics can be affected by variables such as poor lighting, low-quality images, or technical issues on older devices, potentially hindering usability.

How to Overcome It:

- Adaptive Technology: Implement biometric solutions with advanced algorithms that are resilient to adverse conditions.

- Continuous Updates: Regularly enhance biometric systems to adapt to new scenarios and emerging technologies.

- Mobile Optimization: Ensure solutions work efficiently across a wide range of devices, from the most modern to the most basic.

By addressing these challenges, financial institutions can fully leverage the benefits of biometric technology, enhancing security while delivering a superior customer experience.